Farm loan waiver schemes do not help in the long run. Only fundamentally higher farming productivity will.

The dangers of Loan Waiver schemes

[ ##thumbs-o-up## Share Testimonial here - make our day!] [ ##certificate## Volunteer for Bodhi Booster portal]

- Populism trumps good Economics : Loan waiver can be a populist poll promise, but carries a huge economic load. The BJP government of UP, in its first cabinet meeting, announced waiver of small and marginal farmers’ crop loans up to Rs. 1.00 lakh as promised by the PM himself during the election campaign. This creates an additional burden of Rs.36,359 crore on the state exchequer (of which crop loan amount is Rs.30,729 cr).

- Regulator unhappy : The RBI Governor Dr. Urjit Patel also criticized the state government’s move saying that it would not only give way to such demands in other states also, but such moves also result in a transfer from the borrowers to the taxpayers and adversely affect the national balance sheet.

- Agri woes run deep : Loan waivers may make political sense in the short term, but it’s unlikely to help the agricultural sector in the long term. SBI Chairperson Arundhati Bhattacharya said that loan waivers affect credit discipline. Former RBI Governor Raghuram Rajan also said that frequent loan waivers affect credit pricing and disrupt credit market.

- Debt reliefs not a panacea : It can be argued that farmers were not able to invest due to debt overhang. But studies show that there was no evidence of greater investment, consumption or positive labor market outcomes in areas where debt relief led to a significant reduction of household debt.

- Fiscal discipline? Besides, there is a huge fiscal cost attached. Economists at SBI have calculated that loan waiver in Uttar Pradesh will cost about Rs.27,420 crore or about 8% of state revenue. The 2008 farm loan waiver, which benefited about 37 million farmers, resulted in a cost of over Rs.52,000 crore to the exchequer.

- Deep Dive : Read our Bodhi on Agriculture here

- Support yes, Waiver no : There is no doubt that agriculture sector needs government support, but loan waiver is not the solution to this problem. On the contrary, expenditure on loan waiver eventually leaves less fiscal space for public expenditure in agriculture.

- Long term thinking needed : India needs investments in areas such as irrigation, water conservation, better storage facilities, market connectivity and agricultural research. The problems in Indian agriculture are structural and need long-term solutions. Loan waivers will result in further complicating the problem rather than solving it. Loan waivers will also weaken the rural credit institutions that extend loans to farmers.

- Do check out exams-focussed Confidence Booster series of learning resources, here!

- Download Resources : Also, download Agriculture related reports from Bodhi Resource page, here

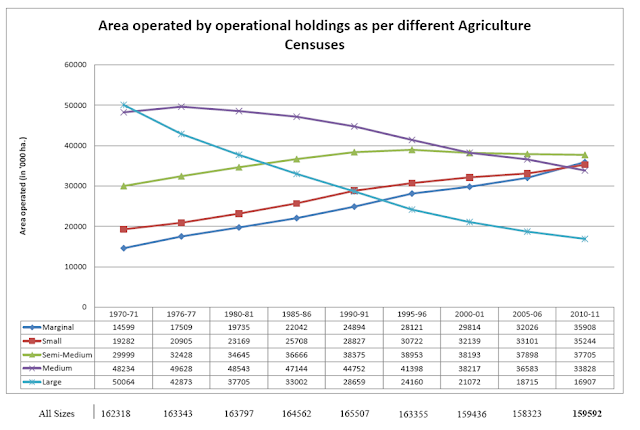

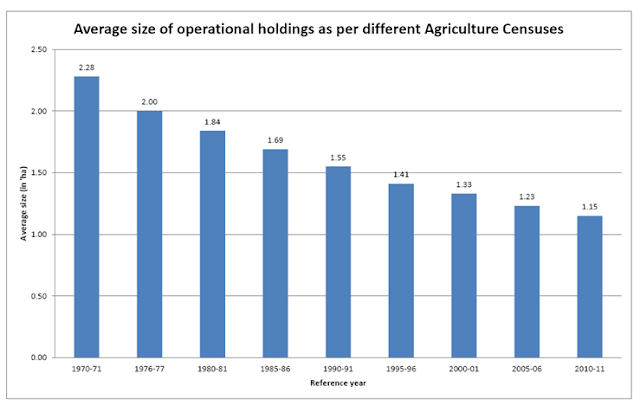

- Some images for data and facts are presented below, for your reference. Studying them will give you a deep understanding of the root causes of farmers' distress, and why waivers cannot solve the same.

The first Central scheme for loan waiver (1990)

The second major Central scheme for Agri relief (2008)

As long as fragmentation of land continues, and Agri productivity remains low,

relief schemes will have little impact

The poor landholding situation aggravates the situation

Public investment in Agri has to be stepped up dramatically.

The latest foodgrain production figures for 2016-17 present a good picture, although!

Amazing Courses - Online and Classroom

Useful resources for you

[Newsletter ##newspaper-o##] [Bodhi Shiksha channel ##play-circle-o##] [FB ##facebook##] [हिंदी बोधि ##leaf##] [Sameeksha live ##graduation-cap##] [Shrutis ##fa-headphones##] [Quizzes ##question-circle##] [Bodhi Revision ##book##]

COMMENTS